can never understand the present,

and he certainly can do nothing for the future.

John Diefenbaker

Why are the provincial and federal governments of Canada

drowning in sovereign debt?

The short answer is interest.

The long answer is in a 1974 policy shift

under Prime Minister Pierre Trudeau

and Bank of Canada Governor Gerald Bouey.

A shift from the Bank of Canada funding government deficits

to borrowing money on the open market at market rates,

combined with compounding interest.

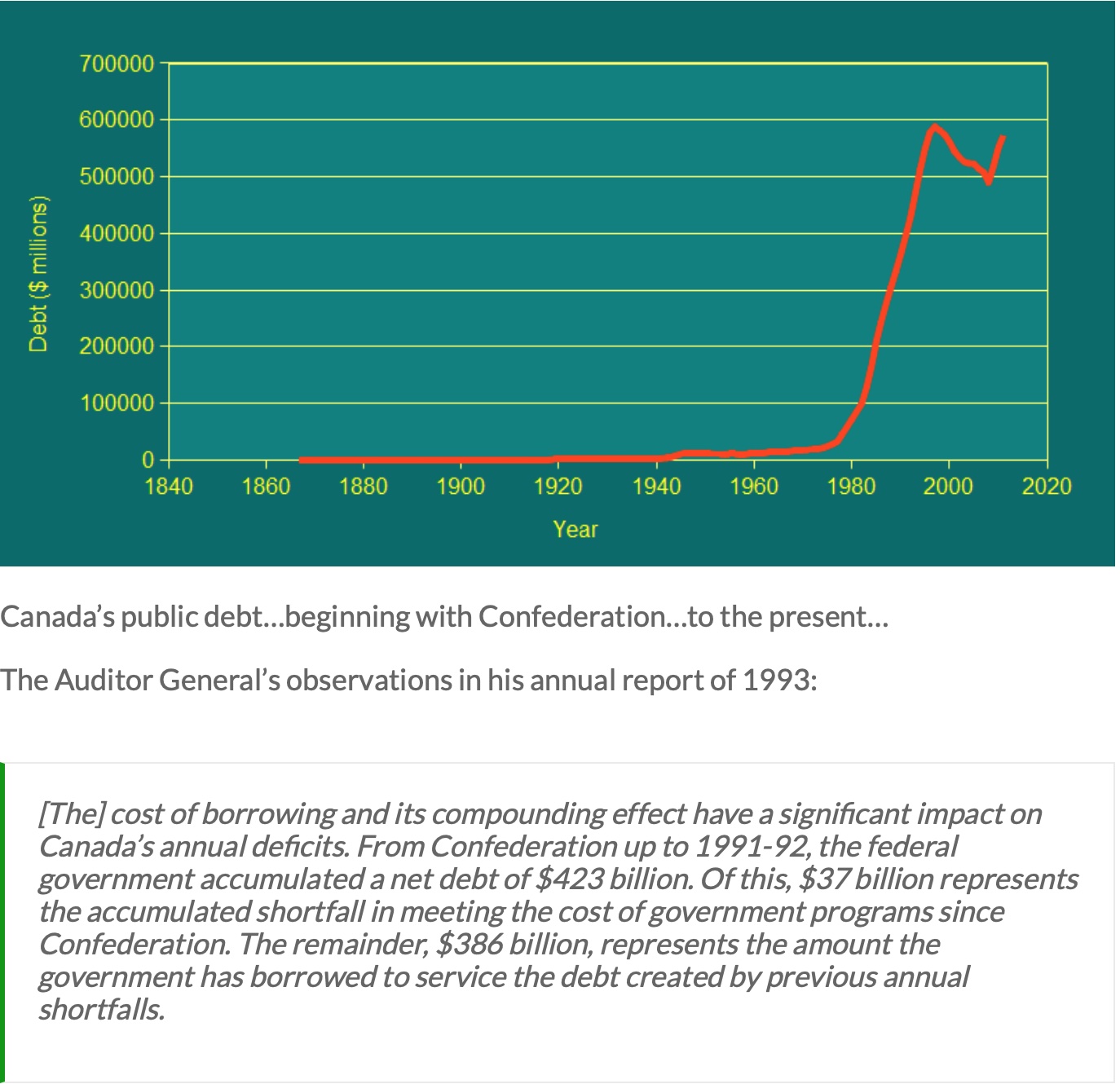

The evidence of this policy shift

is contained in the graph of our sovereign debt.

Rather than reducing government indebtedness,

as was the stated intention,

the opposite occurred.

I find it astounding that no one at the Bank of Canada

or in Parliament

noticed and if they did they were silent.

Looking at the graph before 1974 and later is evidence of malfeasance

on the part of Parliament and the Bank of Canada

to the benefit of private investors.

The Bank of Canada and Parliament could not help but notice

that before borrowing at market rates

our sovereign debt was small

compared to borrowing at market rates.

Graham Towers, the first and longest serving Governor of the Bank of Canada

stated before the 1939 House of Commons Standing Committee on Banking and Commerce:

The major function of a central bank is to regulate credit and currency

in the best interests of the economic life of the nation.

Ninety-one percent of our debt being interest payments to private investors

is not in the best interests of the economic life of the nation.

To remedy the situation the Bank of Canada

needs to fund government deficits

as was done previous to 1974.

Mark Carney is a finance capitalist

who previous to becoming the Prime Minister

was the Governor of the Bank of Canada

and sat on the managing board

of the BIS as a representative of the Bank of Canada.

He also served on the BIS in his capacity

as the Governor of the Bank of England.

Carney may well be benefiting from the present situation,

that being, the Bank of Canada borrowing on the open market.

Requesting the Bank of Canada return to its previous policy

of funding government directly

will be met with strong opposition,

however I see no other path forward

if Canada is to maintain its sovereignty

allowing young Canadians to thrive as a free people

avoiding a life of debt slavery.

When a government is dependent upon bankers for money,

they and not the leaders of the government control the situation,

since the hand that gives is above the hand that takes.

Money has no motherland;

financiers are without patriotism

and without decency;

their sole object is gain.

-Napoleon

When Canadians are informed of the plundering of their tax dollars

by private investors, they may well act to stop the plunder.

An organic grouping of Canadians, with the intention of requiring the federal government

and Bank of Canada to reverse the 1974 policy of borrowing on the open market at interest

and reinstate the policy of governments borrowing directly from our Bank of Canada,

a crown corporation, which was formed to relieve our governments of the burden

of paying interest to private investors.

Be wary of controlled opposition such as the Frazer Institute

and the National Citizens Coalition (NCC);

either they are very stupid and did not do their homework,

or more likely they support Canada having a trillion dollar deficit

funded by the hard work of the people of Canada through their taxes.

supplemental reading Central Banks are Trojan Horses Looting their host nations